Hello again!

There is a concept in finance and accounting known as “opportunity cost.” This simply means using your financial resources in one area will sacrifice another area. There is no better example of this than consumer debt. Financial freedom and a path for building wealth is dependent upon you using your tools – your own undertaking (Y.O.U.), your income, and time – to your benefit and your advantage.

Before you read on, please take a few minutes and review my previous post, “Time Is Of the Essence.” In that post, I showed what a $100 monthly investment for a person in his/her 20’s can become by the time of retirement.

To express this concept, let’s use some averages that relate to credit cards.

- According to Forbes.com, the average credit card interest rate (aka APR – annual percentage rate) is more than 24%. That’s 2% per month!!!

- According to creditcards.com by Bankrate, the average monthly credit card balance is $5,910. For all intent and purposes (and easy math), let’s use $6,000 for the purposes of this post.

There are several ways banks and credit card companies calculate their customers’ minimum payments. One common format is 1% of the balance plus the interest accrued. The monthly payments with the scenario above begins at $180 (1% of balance = $60, plus 2% monthly interest rate = $120 –> 60+120 = 180). Using an online calculator at www.calculator.net, paying the minimum payment every month will take you 4 years and 8 months (56 months total) to pay off this balance. At the end, you will pay just under $4,000 in interest ($10,000 total). What is your real interest rate? That’s easy to figure out, $4,000 divided by $6,000 = 66.67%. You paid 2/3 more than is owed.

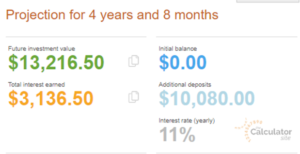

Our consumer decided to use debt to purchase $6,000 of consumer goods or services. Let’s see what the result would be if our consumer did not make $6,000 of purchases, but instead, invested $180 per month in his/her 401(k) or in an IRA for 4 years and 8 months.

The consumer’s opportunity cost is more than $7,000. The total of $10,000 in payments resulted in a loss due to interest of nearly $4,000 when the same $10,000 invested could have resulted in a gain of more than $3,100. That’s opportunity cost in a nutshell.

This is an example of how one change can make a difference in your personal finances. The most dramatic impact is moving from debt to cash. Most households are currently living paycheck-to-paycheck and for many this is a result of having debt.

Here are a few steps to take in order to have your money work for you instead of someone else:

- Create a small emergency fund. This will help put some cushion between you and life. For most people, any amount between $1,000 and $2,500 – depending on current situation – will do. This fund will help prevent you from adding to any debt as you start your journey to financial wellness.

- After your small emergency fund is good to go, pay off all of your consumer debt AS SOON AS POSSIBLE. This includes credit cards, student loans, vehicle payments, tax liens, etc. However, this does NOT include your home. We’ll have a post about that later. Remember, the longer you pay these lenders, the richer they become, not you.

- After all of your consumer debt is paid, grow the emergency fund to a full 3 to 6 months of expenses. You don’t need a credit card or other debt sources for emergencies. You need MONEY. These 3 steps will help stop any financial “bleeding” you have and allow you to have a new outlook for your financial future.

After these steps are done, now you have decisions that can be made regarding your investing, saving, and long-term goals. You will be able to use your money for your financial growth, not the lenders’ profit margins. The greatest barrier for most people’s finances is their consumer debt. Eliminating barriers to wealth helps create a clearer path to financial freedom.

In the next post, I’ll go a little more into detail for how to eliminate debt in the fastest way possible.

Thank you for reading!

If you are interested in financial coaching, please feel free to contact IFC directly through the website, www.ifcmoneycoach.com, by phone at (619) 551-4625, or via email at tim@ifcmoneycoach.com.

All introductory consultations are free and come with no obligation.